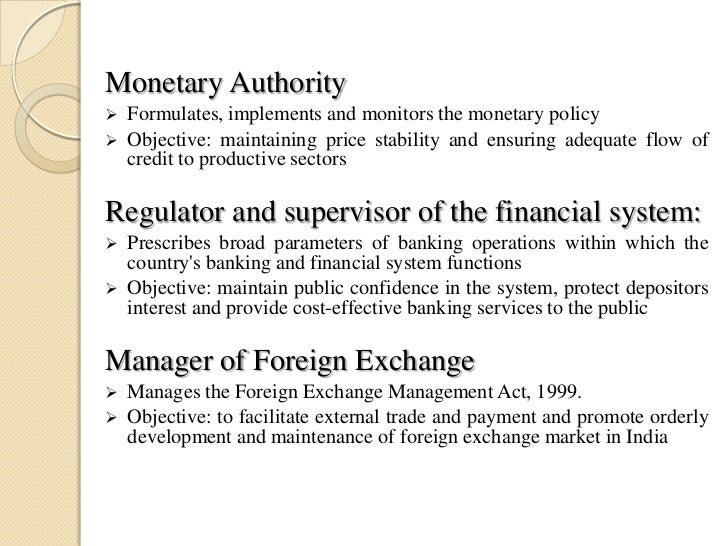

Also, it keeps an eye on the financial transactions of the banks so that amount of account holders remain secured in the banks. However hereby RBI plays a role lender that lends money to the primary banks of India on certain interests.

Acting as a Central Bank for other Banks: The Reserve Bank of India acts as a parent bank to all the primary banks operating in India.For example, during demonization, RBI discounted old 500 rupee notes and added new 2000 and 500 rupee notes. Also, the addition of any new denomination or discontinuation of any existing denomination is being done by RBI. As per the MRS, the RBI keeps a reserve asset of Rs 200 crore out of which INR 120 crore would be in form of Gold and the rest in the form of foreign currency. The issue and printing of currency notes in India are regulated under the Minimum Reserve System (MRS). The Reserve Bank of India prints notes of all denominations except 1 rupee and that’s because the one rupee note is issued by the Indian Ministry of Finance. Issue Currency Notes: The issue and printing of currency notes are one of the primary functions of the RBI.Achievements of India’s Industrial Sector Between 1950-1990įunctions of RBI What are the Main Functions of RBI?.Educated Unemployed - A Peculiar Problem of India.Challenges For Indian Women Against Time and Space.Role of Energy for Economic Development.How to Protect Workers in the Unorganized Sector?.Population as an Asset for the Economy Rather Than a Liability.Role of Supermarkets in the Supply Chain Management.Main Characteristics of Capitalist Economy.Trade and Investment Policy Reforms Since 1991.

0 kommentar(er)

0 kommentar(er)